Charting New Horizons: Expanding Your Wide Range Administration Portfolio With Offshore Count On Services

The Advantages of Offshore Depend On Solutions in Riches Monitoring

You'll be impressed at the benefits of overseas count on services in wide range administration. Offshore depend on solutions provide a wide array of advantages that can significantly boost your riches management profile.

Secondly, offshore trust fund services provide boosted discretion. Unlike conventional onshore trusts, offshore trust funds supply a higher degree of privacy and discretion. This can be particularly advantageous for individuals that value their financial personal privacy and desire to maintain their properties away from prying eyes.

Furthermore, offshore trusts offer tax advantages. Lots of offshore jurisdictions provide desirable tax regimes, allowing individuals to legitimately lower their tax obligations. By making use of offshore depend on solutions, you can reduce your tax commitments and retain a larger part of your wealth.

Additionally, overseas trusts enable worldwide diversity. By purchasing foreign markets and holding possessions in various territories, you can spread your threat and potentially enhance your financial investment returns. This diversity strategy can help you accomplish long-lasting economic development and security.

Key Considerations for Integrating Offshore Depends On Into Your Profile

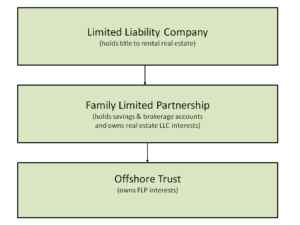

When including overseas trusts into your investment strategy, it is necessary to think about vital variables. Offshore trusts can supply countless benefits, such as asset security, tax advantages, and personal privacy. Nonetheless, prior to diving into this type of investment, you require to thoroughly examine your objectives and goals.

To start with, it's essential to choose the best territory for your overseas trust fund. Different countries have various regulations and guidelines, so you require to locate a territory that lines up with your particular demands. You need to take into consideration aspects such as political stability, lawful structure, and track record.

Secondly, you need to completely research study and select a credible trustee to manage your overseas depend on. The trustee plays an important role in securing and providing your possessions. Search for a trustee with a strong record, know-how in offshore trust fund monitoring, and strong financial security.

Furthermore, you should recognize the coverage requirements and tax obligation ramifications related to overseas counts on. It's vital to follow all applicable regulations and guidelines to prevent any kind of legal concerns or fines in your house nation.

Last but not least, it's important to consistently evaluate and monitor your offshore depend guarantee it stays straightened with your financial investment goals. Economic and political modifications can affect the performance of your count on, so remaining notified and positive is vital.

Exploring International Jurisdictions for Offshore Trust Solutions

Choosing the appropriate territory is crucial when exploring international options for offshore trusts. With so many countries providing offshore count on services, it is essential to think about different variables prior to making a decision.

Another important factor to consider is the tax obligation advantages used by the jurisdiction. Various countries have various tax legislations and policies, and some may offer more desirable tax obligation prices or exemptions for offshore counts on. By meticulously analyzing the tax obligation implications of each jurisdiction, you can optimize your riches and minimize your tax liabilities.

Ultimately, consider the ease of doing company in the jurisdiction. Try to find countries with solid monetary facilities, effective governing structures, and a supportive organization setting.

Making Best Use Of Tax Obligation Performance Via Offshore Trust Fund Frameworks

Taking full advantage of tax efficiency can be achieved with offshore trust structures that provide favorable tax obligation prices and exemptions. By establishing an offshore depend on, you can tactically handle your wide range and minimize your tax responsibilities.

One of the key benefits of offshore trusts is the ability to postpone tax obligations. By putting your assets in a trust, you can delay the settlement of taxes up until a later date or also prevent them completely in many cases. This can be particularly beneficial for individuals with considerable financial investment income or those who anticipate future tax obligation rises.

Moreover, offshore trust funds supply a level of privacy and asset defense that you may not locate in your house territory. By placing your properties in an offshore count on, you can protect them from prospective financial institutions and legal conflicts. This can provide comfort and safeguard your wide range for future generations.

It is crucial to keep in mind that while overseas trust funds provide tax advantages, it is vital to abide by all suitable tax obligation legislations and regulations. offshore trust services. Working with knowledgeable professionals who specialize in offshore trust fund structures can make certain that you optimize tax obligation efficiency while staying fully certified with the law

Mitigating Risk and Enhancing Property Security With Offshore Counts On

To alleviate danger and improve possession protection, you my blog can depend on offshore trust funds, which provide a degree of privacy and lawful security that might not be available in your home territory. Offshore counts on offer a critical service for guarding your riches by placing your properties in a different lawful entity outside of your home country. By doing so, you can protect your possessions from potential creditors, claims, and other risks.

Among the primary advantages of using offshore depends on is the level of privacy they afford. Unlike in your home territory, where your monetary info may be quickly accessed by federal government authorities or other interested events, offshore trust funds provide a greater degree of discretion. Your monetary and individual information are maintained private, permitting you to maintain a greater degree of control over your possessions.

Furthermore, overseas trust funds can use enhanced asset defense. In the event of litigation or monetary problems, having your properties in an offshore depend on can make it more tough for creditors to reach them. The trust functions as a barrier, offering an added layer of defense and making it harder for any individual seeking to take your properties.

In enhancement to personal privacy and asset protection, offshore counts on can likewise provide tax benefits, which even more add to your overall risk mitigation approach. By meticulously structuring your count on, you can potentially decrease your tax liabilities and enhance your estate planning.

Final Thought

To conclude, by incorporating overseas depend on solutions right into your wide range monitoring profile, you can delight in various advantages such as tax obligation effectiveness, property security, and access to worldwide jurisdictions. It is essential to meticulously take into consideration key aspects when choosing overseas trust funds, such as reputation, regulative structure, and professional experience. With proper planning and guidance, you can broaden your financial investment perspectives and guard your wide range in a globalized globe. Do not lose out on the opportunities that offshore depend on solutions can supply to expand and shield your visit the website wide range.

Unlike typical onshore trusts, offshore counts on offer a greater level of personal privacy and discretion. Offshore depends on can provide countless advantages, such as asset security, tax benefits, and privacy. Various nations have different tax obligation laws and laws, and some may supply much more favorable tax obligation prices or exemptions for overseas counts on.Making best use of tax performance can be accomplished via offshore depend on structures that provide positive tax obligation rates and exemptions.In final thought, by integrating offshore count on services into your riches management portfolio, you can delight in many site advantages such as tax efficiency, asset protection, and access to international jurisdictions.